How to download pan card copy : A PAN card is a very important document. Along with filing income tax returns, this document is required for opening a bank account, taking loans from banks, etc. If you want to download a PAN card online, then the way is easy. You can also download it through NSDL, UTIITSL, and the Income Tax e-Filing website. Let’s tell you how to download PAN card copy ?

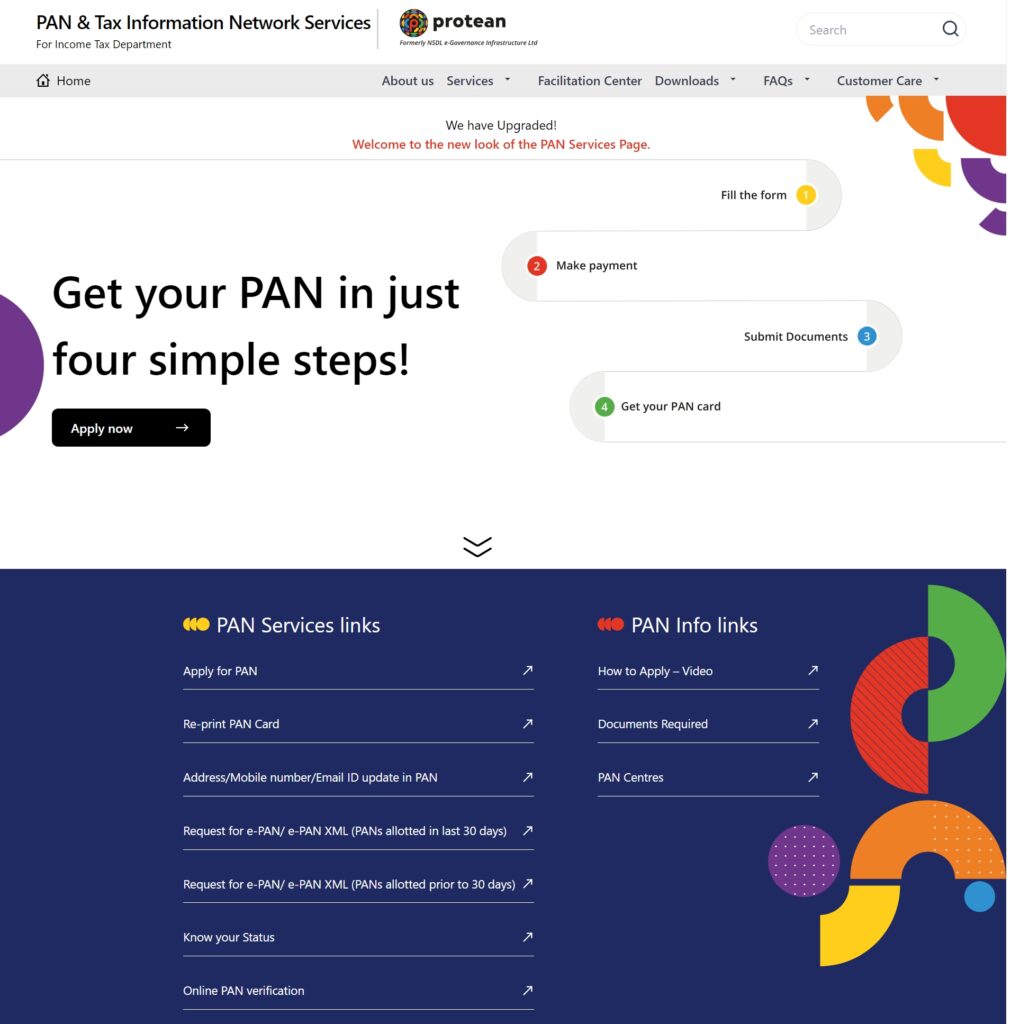

How to download PAN card copy from NSDL portal?

You can download the e-PAN card copy online through the NSDL and UTIITSL portals. For this, you can take the help of Aadhaar card. To download the e-PAN card from the NSDL website, follow the steps given below:

Step 1: First, you need to go to the official NSDL Protean portal website (Protean PAN Services – PAN Card Application & Issuance).

Step-2: From the dropdown, you can select the option of ‘Download e-PAN/e-PAN XML (PANs allotted in last 30 days)’ or ‘Download e-PAN/e-PAN XML (PANs allotted prior to 30 days)’ as per your convenience. After this, you will be redirected to a new page.

Step-3: Now on the next page, you can choose the ‘Acknowledgement Number’ or ‘PAN’ option. When you select the ‘PAN’ option, enter your PAN number, Aadhaar number, date of birth/incorporation and GSTN (if applicable), and captcha code and click on the ‘Submit’ button.

Step-4: On the other hand, if you choose the option of ‘Acknowledgement Number’, then enter the acknowledgment number, date of birth, and captcha code and click on the ‘Submit’ button.

Step 5: After selecting any one of the options, tick the declaration below and click on the ‘Generate OTP’ button.

Step-6: Now you have to click on the ‘Verify’ button after entering the OTP.

Step 7: Click on the ‘Download PDF’ button. If the free e-PAN download is finished, you will see a notification on the screen.Click ‘Continue with paid e-PAN download facility’ and select a payment method. After making the payment, click on the ‘Download PDF’ button.

The e-PAN card will be downloaded as a PDF. This comes with a password, and the password is your date of birth.

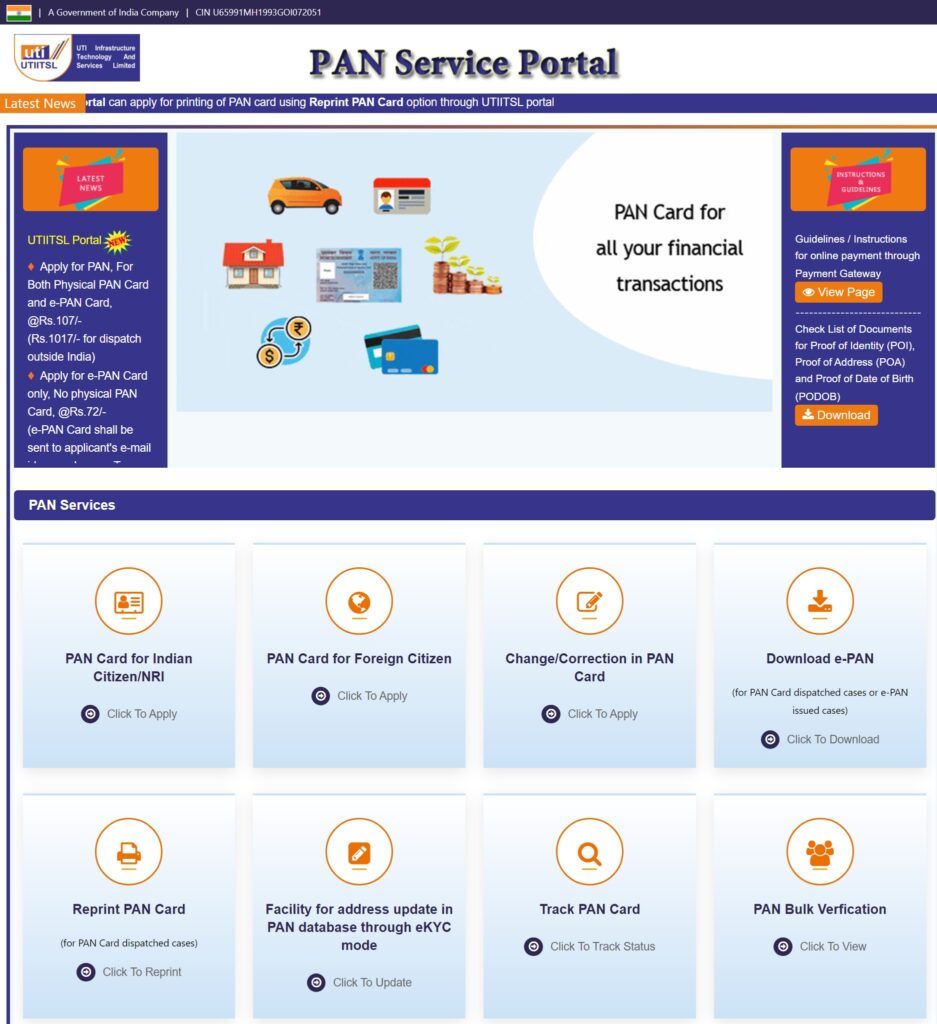

How to download PAN pan card copy from UTIITSL portal?

You can download the e-PAN through the UTIITSL website. If you have applied for a new PAN card or have made changes in it, you can download it for free within 30 days. After this, you will have to pay for downloading. To download through UTIITSL, follow the steps given below:

Step-1: First of all, visit the official UTIITSL portal https://pan.utiitsl.com/.

Step-2: Then scroll down and after clicking on the ‘Download e-PAN’ tab, you have to click on the ‘Click to Download’ option.

Step 3: After this, you will be redirected to a new page, where PAN number, date of birth, captcha code will be entered. Then click on the ‘Submit’ button.

Step 4: A link will then be sent to your registered mobile number or email id. One has to click on the link and download the e-PAN card using OTP.

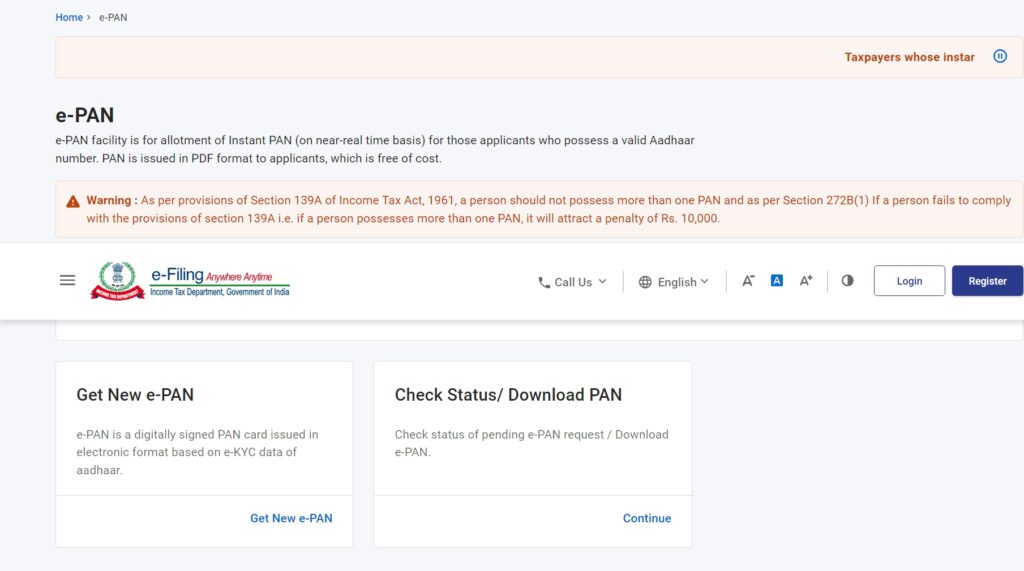

How to download PAN card using Aadhaar number?

The e-PAN can be downloaded through the Income Tax e-filing website. For this, you will need an Aadhaar card number. For this, you can follow the steps given below:

Step 1: Visit the official income tax e-filing website (https://eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan/checkStatusDownloadEpan) .

Step-2: Here you will find ‘Check Status’ Tap on the ‘Download PAN’ option, then click on Continue.

Step 3: Enter your Aadhaar number and click on the ‘Continue’ button.

Step 4: After this, enter ‘Aadhaar OTP’ sent to the Aadhaar registered mobile number and click on ‘Continue’.

Step 5: Your e-PAN status will appear on the screen. When the new e-PAN is allotted, click on ‘Download e-PAN’ to download the e-PAN copy.

FAQs

What is PAN Card Customer Care Number?

If you have any queries related to PAN card, then contact the customer care number +91-20-27218080 of the Income Tax Department, the customer care number of UTIITSL +91-33-40802999, 033-40802999 and

NSDL customer care number 020-27218080, 08069708080.

Is an ePAN card a legal document?

Yes, the ePAN card is as legal as a traditional PAN card. Both are the same document.

What is the fee for downloading an ePAN card?

If you download the e-PAN card within one month of the application, then there is no charge, while if you download the e-PAN card after 30 days, then the fee is Rs 8.26 on the UTIITSL website.

Is there any app available to download PAN card?

No, there is currently no app available to download PAN card. You have to visit the website of NSDL or UTI to download the PAN card online.

Can I download a PAN card without an Acknowledgement Number?

Yes, you can also download the PAN card without an acknowledgment number. You can take the help of PAN number, Aadhaar number, date of birth or GSTIN (optional) for this.