Recently the Government of India has approved the ‘PAN 2.0 Project’, which is closely linked to the e filing 2.0 PAN card system. This new project has been started with the aim of making the registration of taxpayers easy and secure. PAN 2.0 will be QR code based and will have better security and authentication features than before. In this guide, we will tell you in detail about PAN 2.0 and how to apply efiling 2.0 pan card and how to get a reprint:

What is PAN 2.0 Project?

The PAN 2.0 project is a new form of PAN card, which is being designed keeping in mind the easy and better digital experience for the taxpayer. Under this scheme, all the services related to PAN and TAN will be linked on a single online platform, so that all work becomes paperless and easy. This new system will provide a centralized portal for all PAN-related services, which will also have strong cybersecurity to keep users’ information safe.

The purpose of PAN 2.0 is to use PAN as a digital identity in government work, so that it becomes easier to follow the rules. It stores the PAN card information in a QR code, which is sent to an email ID in a secure manner. It aims to provide PAN deletion in a more secure and accessible manner for PAN card holders. The PAN 2.0 QR code along with the physical PAN card will remain valid and can be offered for various government and non-government purposes.

How to Apply e filing 2.0 pan card?

Through both NSDL and UTIITSL portals, you can apply to get PAN 2.0. For this, the procedures given below have to be followed.

How to Apply e filing 2.0 pan card from NSDL website

Step-1: First of all, visit the NSDL PAN portal onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html

Step 2: Here you will have to fill in your PAN number, Aadhaar number, date of birth and CAPTCHA. Then click on the ‘Submit’ button. (If this notification shows that your email ID is not linked to the PAN, you will be instructed to update the email ID.) You will be provided with a link for this process, where you can update your information.

Step-3: When you ‘Submit’, all the details registered with NSDL will appear on the next screen. You can choose how to get OTP from here – phone number, email ID or from both options.

Step 4: OTP will be sent to the medium (phone number or email) you choose. Enter it and then fill out the CAPTCHA. After this, go to the PAN card portal and accept the given terms and conditions.

Step 5: If you have received a physical PAN card within the last 30 days, the PAN 2.0 QR code will be free. Otherwise you will be charged Rs 8.26.

Step 6: You can choose any payment option from debit card, credit card, net banking etc. After completing the payment, the PAN 2.0 QR code will be sent to your email, which you can print.

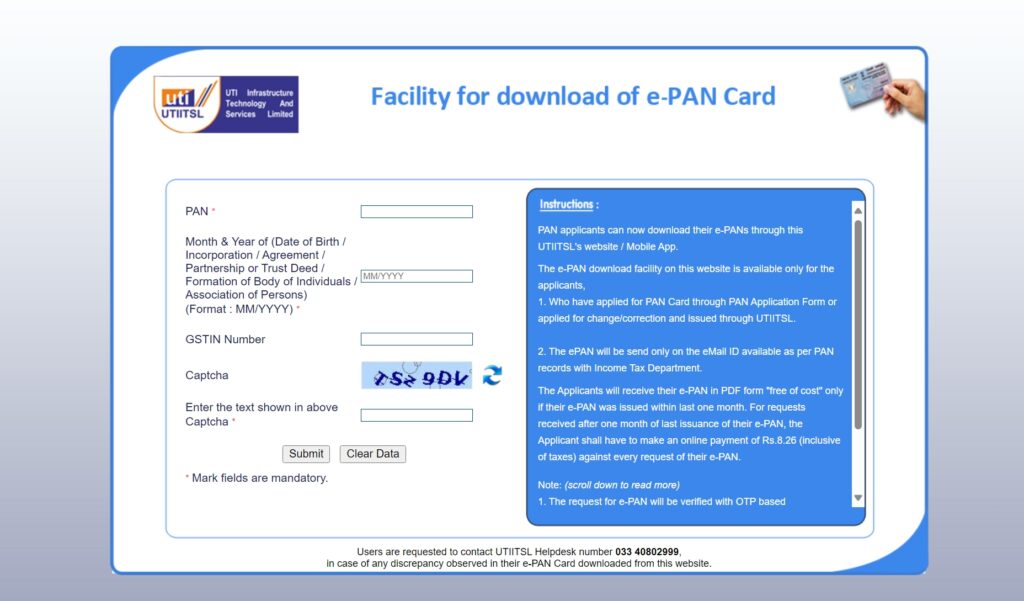

How to apply e filing pan card 2.0 from UTIITSL website

If you have obtained the PAN card from the UTIITSL portal, then follow this procedure: Step-1: Open the UTIITSL website Facility for download of e-PAN Card in your browser.

Step 2: Here you have to fill in your PAN number, date of birth, and CAPTCHA. Then click on ‘Submit’.

Step-3: The registered email ID will be shown on the next page. Make sure it’s correct, then move on.

Step-4: You need to pay to get a PAN 2.0 QR code. If you have received a physical PAN card within the last 30 days, it will be free of cost. Otherwise, you will have to pay Rs 8.26.

Step 5: You have to select the mode of payment (Debit Card, Credit Card, Net Banking) and then complete the payment.

Step-6: After making the payment, the PAN 2.0 QR code will be sent to your registered email.

What is the difference between PAN 2.0 and an existing PAN card?

The main difference between PAN 2.0 and a normal PAN card is that PAN 2.0 will have a QR code, just like the Aadhaar card. However, the purpose and use of both systems are the same. It can only be decrypted through authorized software. A normal PAN card does not have such a QR code. As soon as a new PAN card is issued in PAN 2.0, it will be sent directly to the email. This card is completely digital and can be used through any electronic medium. The verification process will be faster and safer because of the QR code in PAN 2.0. Authorized entities will be able to easily retrieve the data from the server, which will enable faster verification. Normal PAN card does not have this type of facility. The purpose of both PAN 2.0 and a normal PAN card will remain the same.

PAN 2.0 Features & Benefits

- PAN 2.0 has been linked to various platforms such as e-Filing Portal, UTIITSL and Protean e-Gov, making it more convenient for taxpayers to use PAN services.

- QR codes are used for security in PAN Card 2.0, which can only be read by authorized software.

- The security system of PAN 2.0 prevents its duplication, which will reduce the cases of fraud.

- PAN 2.0 data can be easily accessed from servers by authorized organisations, thereby speeding up the verification process.

FAQs

Will the physical PAN card remain valid even after PAN 2.0?

Yes, both the physical PAN card and the PAN 2.0 QR code will both be valid documents. These can be submitted for authenticity as needed.

Do I have to pay for a PAN 2.0 QR code?

If you have received a physical PAN card within the last 30 days, you will get a PAN 2.0 QR code free of cost. Otherwise, a fee of Rs 8.26 will be charged.

What are the documents required for PAN 2.0?

If you already have a PAN card, no additional documents are required to generate PAN 2.0. Just make sure that your registered email ID is correct and that it is linked to the PAN. The PAN 2.0 QR code will be sent to your email.

Is Re-KYC required for existing PAN holders after PAN 2.0?

No, there is no re-KYC requirement for existing PAN holders. If your PAN card is active, you will not need any additional verification under PAN 2.0.

Is PAN 2.0 for individuals and businesses?

Yes, PAN 2.0 is applicable for both individuals and businesses.

Will PAN 2.0 affect my GST number?

No, PAN 2.0 will not affect your GST number. You can continue to file GST through your existing PAN card.