Table of Contents

Table of Contents

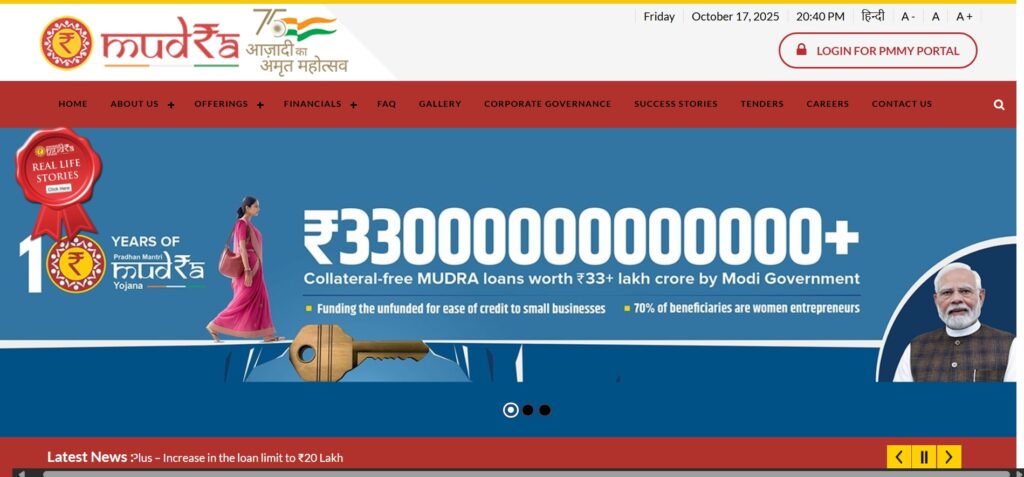

Pradhan Mantri Mudra Yojana Online Apply: If you’re planning to expand your local business or start a new venture, then applying online for the Pradhan Mantri Mudra Yojana is really the best way to get affordable financial support from the Indian government. This key scheme provides loans to local entrepreneurs in manufacturing, business, or service sectors to help them generate decent income.

What is the Pradhan Mantri Mudra Yojana (PMMY)?

The Pradhan Mantri Mudra Yojana (PMMY) is a major financial inclusion scheme initiated by the Government of India, aimed at empowering small and micro-entrepreneurs. This scheme provides loans up to ₹20 lakhs to help micro-enterprises grow and create employment opportunities. Whether you run a small manufacturing unit, a shop, a food service business, or agricultural support activities such as poultry or dairy farming, this scheme has been designed for you.

Who Can Apply Under Pradhan Mantri Mudra Yojana?

The scheme covers a wide range of small business owners and self-employed individuals, including:

- Small manufacturing units

- Service sector businesses

- Shopkeepers and traders

- Artisans and small industries

- Fruit and vegetable vendors

- Truck operators and food processors

- Machine operators and repair shop owners

In short, any individual or business entity engaged in income-generating non-farm activities can take advantage of the Pradhan Mantri Mudra Yojana online apply process.

Member Lending Institutions (MLIs)

Applicants can avail of loans through any of the following Member Lending Institutions (MLIs):

- Public Sector Banks

- Private Sector Banks

- Regional Rural Banks

- State Cooperative Banks

- Microfinance Institutions (MFIs)

- Non-Banking Financial Companies (NBFCs)

- Small Finance Banks (SFBs)

- Other financial intermediaries approved by MUDRA Ltd.

These institutions act as the backbone of the Pradhan Mantri Mudra Yojana online apply system, ensuring that every eligible entrepreneur can access funds conveniently.

Interest Rates and Processing Charges

Interest rates under PMMY are determined according to the guidelines of the Reserve Bank of India (RBI). Each lending institution may establish its own rate based on these guidelines. Typically, the rates are competitive and affordable for small entrepreneurs.

Important Note on Agents

It’s crucial to remember that no agents or middlemen are authorized by MUDRA for processing loans. All applications must be done directly through official bank channels or the government’s Pradhan Mantri Mudra Yojana online apply portal. Always stay cautious and avoid any individuals claiming to be MUDRA representatives.

Loan Categories Under Pradhan Mantri Mudra Yojana

| Loan Category | Target Group | Loan Amount | Purpose / Benefits |

| Shishu Loan | Startups and beginners | Up to ₹50,000 | Best for microenterprises just starting operations |

| Kishore Loan | Growing small businesses | ₹50,000 to ₹5 lakh | Suitable for enterprises looking to expand |

| Tarun Loan | Established small businesses | ₹5 lakh to ₹10 lakh | Helps in scaling operations or purchasing new equipment. |

| Tarun Plus Loan | Successful entrepreneurs who earlier availed of the Tarun Loan | Up to ₹20 lakh | Designed for those looking to grow even further |

Each of these categories is available through the Pradhan Mantri Mudra Yojana online application process, making it easier for businesses at every stage to obtain financial support.

Eligibility Criteria for PMMY Loan

To qualify for a Mudra loan, applicants must meet certain basic eligibility requirements:

- Individuals, sole proprietorships, partnership firms, private limited companies, and public limited companies can apply.

- The applicant should not have any outstanding debts with any bank or financial institution.

- Applicants must possess the skills or experience required for the proposed business activity.

- Educational qualifications are not mandatory but may be necessary depending on the nature of the project.

These simple eligibility norms make it possible for almost anyone who wants to start or grow a small business to apply online for the Pradhan Mantri Mudra Yojana.

Documents Required for Mudra Loan

Applicants need to provide specific documents depending on the loan category. Below is a summary:

For Shishu Loan

- ID Proof (Aadhaar Card, PAN Card, Voter ID, etc.)

- Address Proof (Electricity bill, property tax receipt, etc.)

- Passport-size photographs

- Quotation or invoice for machinery or items to be purchased

- Business proof like trade license or registration certificate

For Kishore, Tarun, and Tarun Plus Loans:

- ID and Address Proof of the applicant and the business

- Last six months’ bank statements

- Balance sheets and income tax/sales tax returns (for loans above ₹2 lakh)

- Project report with business plan and estimated income

- Partnership deed or Memorandum and Articles of Association (for firms or companies)

Having these documents ready in advance will make the Pradhan Mantri Mudra Yojana online apply process smoother and faster.

Step-by-Step Process to Pradhan Mantri Mudra Yojana online apply

Here’s how you can apply easily from the comfort of your home:

- Visit the Official Website: Go to the official PM MUDRA or Udyamimitra portal.

- Click on “Apply Now” under the Mudra Loan section.

- Select Applicant Type: Choose whether you are a new entrepreneur, an existing entrepreneur, or a self-employed professional.

- Register Yourself: Enter your name, mobile number, and email ID, then verify using OTP.

- Fill in Personal and Professional Details: Provide all required information about yourself and your business.

- Choose Hand-Holding Agencies (Optional): If you need help preparing a business proposal, you can opt for assistance.

- Select Loan Category: Choose from Shishu, Kishore, Tarun, or Tarun Plus, depending on your funding need.

- Enter Business Details: Include business name, activity, and industry type, like manufacturing, service, or trading.

- Upload Required Documents: Attach ID proof, address proof, photographs, business proof, and signatures.

- Submit the Application: Once submitted, an application number will be generated for future reference.

That’s it! The Prime Minister’s Mudra Scheme online application process is quick, simple, and completely digital.

Where to Apply for Mudra Loan Offline

If you prefer the traditional method, you can also visit any nearby Public Sector Bank, Private Bank, or Regional Rural Bank branch to apply. Request the MUDRA Loan Application Form, fill it out, attach the necessary documents, and submit it to the loan officer.

Even when applying offline, you can still mention that you are applying under the Pradhan Mantri Mudra Yojana online application scheme to ensure that you receive the appropriate category benefits.

Benefits of Pradhan Mantri Mudra Yojana

The scheme brings several advantages to small business owners:

- No collateral requirement: Most loans under PMMY are unsecured.

- Low-interest rates: Competitive and affordable financing options.

- Easy repayment terms: Flexible tenure based on business type.

- Boost to self-employment: Encourages new entrepreneurs.

- Financial inclusion: Helps small businesses access formal credit channels.

Overall, Pradhan Mantri Mudra Yojana online application empowers entrepreneurs to grow their business confidently with government-backed financial support.

Key Points to Remember

- No middlemen or agents are involved in the process.

- Always apply through the official website or recognized banks only.

- Keep your documents and business plan ready for faster approval.

- Choose the right loan category (Shishu, Kishore, Tarun, or Tarun Plus).

- Maintain a good credit history for smooth loan approval.

You Also Read: Voter ID Card Online Apply 2025 in India

Conclusion

The Pradhan Mantri Mudra Yojana online apply initiative is a great opportunity for small entrepreneurs to turn their dreams into reality. With simplified eligibility, minimal documentation, and digital processing, the scheme opens the door for millions of Indians to become financially independent. Whether you are just starting out or expanding your business, PMMY offers the right kind of financial help to move forward confidently.

By applying today through the Pradhan Mantri Mudra Yojana online apply portal, you can secure the funds you need to grow your business and contribute to India’s economic development.