Angel One Account Opening: Hey friends, do you know that to buy and sell shares in the stock market, you need to have a trading account? If you didn’t know, today we’re going to tell you the process of how to open a trading account before investing in the stock market. Usually, trading companies charge a good amount of money to open a trading account, but today in this post, we’re going to explain the complete process of how to open a trading account for free from the comfort of your home.

Table of Contents

What is a Account?

A Demat Account is considered an important part of the stock market, but it’s compared to your savings account because just like you use your savings account to deposit and withdraw money, a Demat Account holds your shares in the stock market. With a Demat Account, you can deposit shares as you wish and when needed, you can withdraw and sell those shares through your Trading Account.

What’s Angel Account

Angel One is a financial services company in India that provides brokerage services. It was previously known as Angel Broking, which has now been renamed to Angel One. This company primarily offers services in the stock market, commodities, mutual funds, insurance, and portfolio management, which you can use through an online application or web platform.

Who owns Angel One and when was it established?

Angel One, which was previously known as Angel Broking, was founded in 1996 by Dheeraj Gupta. In its early days, this company provided traditional brokerage services, which have now evolved into a digital fintech company.

How safe is Angel One?

Angel One is one of the most popular online trading platforms in India. It’s a SEBI-registered brokerage firm that complies with Indian rules and regulations. Like most platforms, it also offers 2FA, which adds an extra layer of security. It uses various types of firewalls and other security measures for protection. It also employs advanced data encryption. If you face any issues, they have an experienced customer support team available.

How much does Angel One charge?

According to their official website, they currently charge zero brokerage on equity delivery. For intraday, futures, options, currency, and commodities, they charge either ₹20 per order or 0.25% of the transaction value, whichever is lower. You can check the other charges on their official website using the Angel One Calculator.

How to earn money from Angel One?

You can earn money in a lot of different ways from the Angel One Platform, like the share market, mutual funds, derivatives, IPOs, and you can also make money through their refer and earn programs.

Is Angel One listed?

Yes, Angel One shares are listed on the Indian stock exchange and you can buy and sell it there. ‘ANGO’ is its stock symbol.

News about the Angel One data leak.

According to a news report, there were reports of personal data of Angel One’s 8 million customers being leaked, but Angel One completely denied this, stating that their customers’ data is completely secure and no data has been leaked.

What are the benefits of Angel One?

This is one of the most popular online trading platforms in India that helps people with trading and investing. It has many benefits, which are as follows:

- It’s pretty easy to use, even for a new user.

- It offers investments not just in the stock market but also in mutual funds, commodities, and other financial products.

- With its mobile app, you can trade anytime and anywhere.

- It provides detailed information about various companies and the market.

- You can also participate in different upcoming IPOs.

- It has a support team to assist customers.

- It offers various types of brokerage plans with very low brokerage charges on many things.

How to Angel One Account Opening

Registration Process

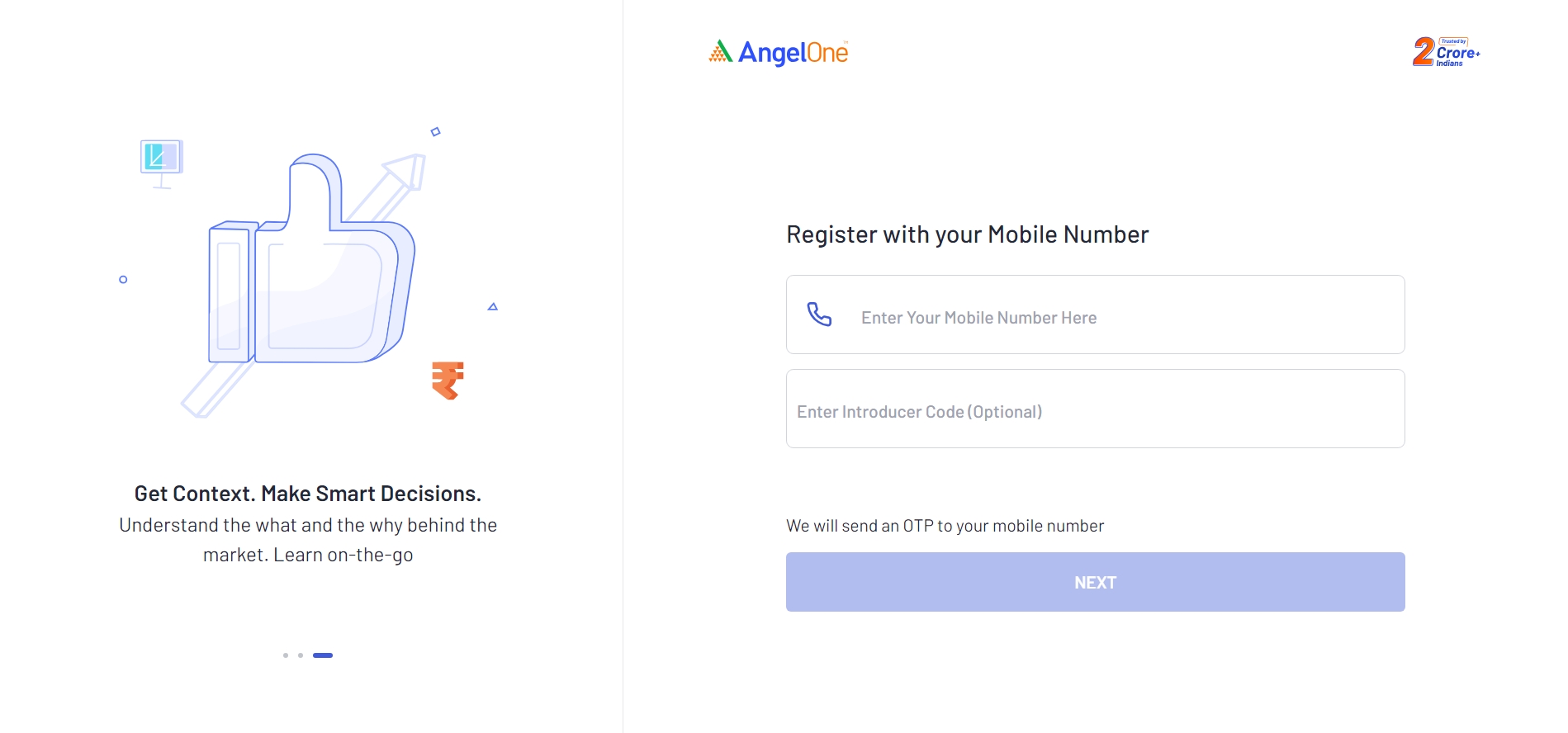

Website link: https://www.angelone.in/signup/register?

- You can open an Angel One Account for free by clicking the link above.

- Download and install the app.

- After opening the app, allow the permissions and sign up to create a new account.

- Enter your mobile number to sign up.

- Accept the permissions for SMS, Contacts, and Location.

- Enter the mobile OTP to verify and click on the Next option.

- Enter your name and proceed.

- Verify by entering your email ID.

- Your PAN card number will be auto-filled, and if it doesn’t appear, you can manually enter it and submit.

Document Upload Process

- Just remember that you can’t upload documents manually here, so having a DigiLocker account is a must.

- Your Aadhar Card and PAN Card need to be linked to your DigiLocker account beforehand.

- To upload documents, enter your Aadhar number and the captcha code, then click on the Next option.

- Enter the OTP registered with your Aadhar and click Continue.

- Enter the 6-digit PIN for DigiLocker.

- Your Aadhar and PAN Card will be automatically fetched from the Angel One account; you just need to click on the Allow option.

Add your Bank Details

- In the Angel One Account, you can add your bank account via Phone Pe, Google Pay, Paytm, and manually.

- Here, we’ll tell you the process to add a bank account manually.

- Click on the option “Add Bank Detail Manually.”

- Enter your bank account number.

- In the confirm section, re-enter your bank account number and IFSC code, then click on the submit option.

- Angel One Account will send 1 to your bank account to confirm it.

Uploads Your Documents

- Click on the Open Camera option to capture a live photo.

- Allow camera permissions and take a selfie.

- After capturing the photo, click on the Save and Continue option.

- Sign live on your screen to complete the signature.

- Click on the Submit option after uploading the signature.

(Note— Proper lighting arrangement No hats, masks, or scarves on the head or face. Both ears should be clearly visible. Your photo should match your Aadhaar and PAN card.)

Account Activation Process

- Click on the option to proceed to activate your account.

- Enter the OTP sent to your registered mobile and click on the Confirm option.

- Click on the option to Link & Provide Consent.

- Enter the OTP to link your bank account with the Angel One Account.

Other Detail

- Enter your income slab.

- Enter the name of your business in Employment Type.

- Enter your father’s name.

- Select marital status and gender, then click on the Proceed option.

- If you want to add a nominee at the same time, click on the Add Nominee option to add a nominee.

- Enter the nominee’s full name, date of birth, and PAN card number.

- In Angel One Account, you can add more than one nominee and also divide the shares among them.

- Enter the percentage of shares for the nominee.

- Enter the relationship of the nominee with the head of the family.

E-Sign Process

- After adding the nominee, click on the Proceed to E-Sign option.

- To e-sign, enter your Aadhaar number or virtual ID and click on the Send OTP option.

- Enter the Aadhaar OTP and click on the Verify OTP option.

Also Reads: Voter ID Card Online Apply 2025 in India

Angel One Related FAQs

How much is the brokerage charge in Angel One?

Angel One charges brokerage on equity delivery. For intraday futures, options, currency, and commodities, they charge either ₹20 per order or 0.25% of the transaction value, whichever is lower.

Who is the owner of Angel One?

Dheeraj Gupta

Is Angel One an Indian company?

Yes, it is an Indian company.

In which year did Angel One start?

This company was started on August 8, 1996

Is Angel One the best for trading?

It varies based on each person’s trading style and needs, but if we look at the record so far, different experiences, and reviews, it can be said that this is a good trading platform in today’s time.